Professional Liability vs General Liability Insurance: A Guide for Contractors

Finding the Right Coverage for Your Business

I speak with contractors every day about their insurance needs, and one of the most commonly overlooked coverages is Professional Liability insurance. Many contractors assume they’re already covered for professional liability when, in reality, they are not. While you may not need this coverage depending on the nature of your work, it’s essential to understand the types of liability you face and whether this protection is necessary. Professional Liability insurance can be a very important component of your overall coverage, so I’ve created this blog to break it down and help you make informed decisions.

For contractors, ensuring your business is adequately protected is key to long-term success. Among the many types of insurance to consider, two often cause the most confusion - professional liability insurance (errors and omissions insurance) and general liability insurance. Although both policies provide vital protection, they address very different risks.

This guide will break down these insurance types to help you understand their distinct roles, so you can make informed decisions about your business’s needs. By the end, you’ll have a clear understanding of which policy is right for your unique situation or whether you should consider both.

What is Professional Liability Insurance?

Coverage for Planning, Design, and Professional Oversight

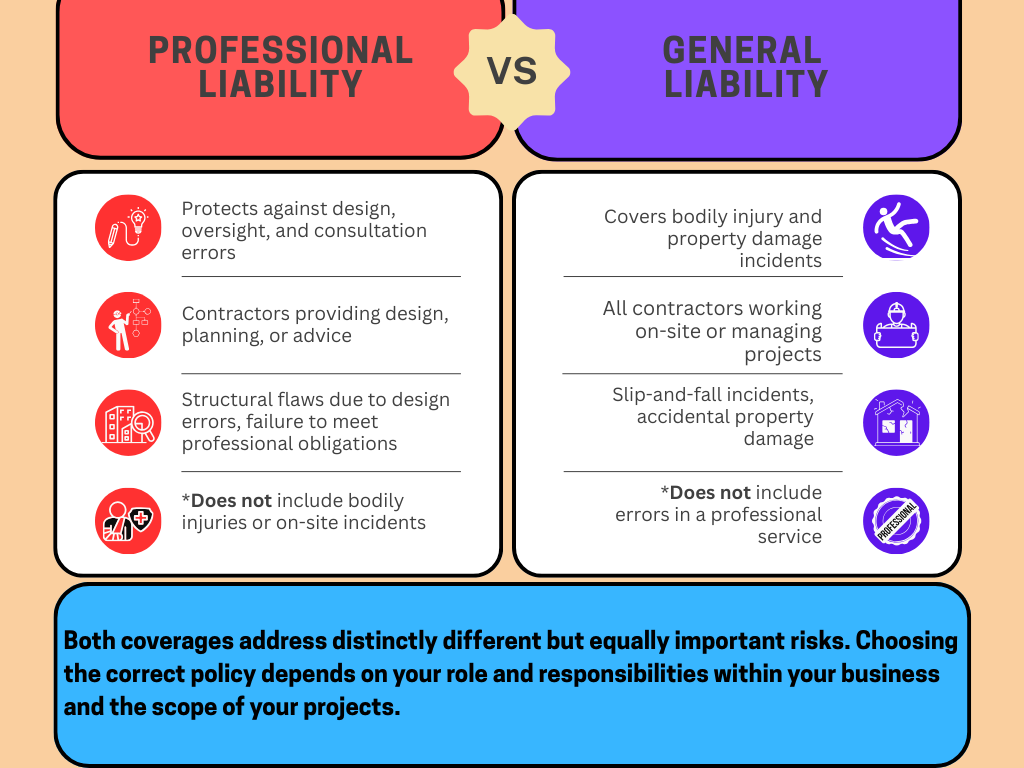

Professional liability insurance, also called errors and omissions (E&O) insurance, is essential for contractors involved in planning, designing, or providing professional services. It shields businesses from claims arising from errors in design, miscommunication, or failure to meet contract specifications.

Who Needs Professional Liability Coverage?

Contractors involved in professional services such as designing blueprints, providing project oversight, or offering consultation are particularly vulnerable to professional liability claims. Here’s an example that highlights its importance:

Example: Suppose an oversight in a design plan you provided leads to a structural defect later on. The client files a claim, asserting that your professional mistake caused them financial harm. Professional liability insurance would help cover legal fees, settlements, and related costs.

What Does Professional Liability Insurance Cover?

Coverage typically includes:

Errors in design or project planning

Omissions or failure to deliver promised services

Miscommunication with clients

Contractual liability (failure to meet agreed terms or deadlines)

This type of coverage is invaluable if your role extends beyond physical construction and involves significant contributions to the project’s conceptual aspects.

What Professional Liability Does Not Cover

Keep in mind, professional liability insurance does not cover bodily injuries, property damage, or accidents that occur on-site. That’s where general liability insurance comes into play.

General Liability Insurance Coverage

Protection Against Bodily Injury and Property Damage

General liability insurance is fundamental to protecting contractors and their businesses against accidents and incidents that result in bodily injury or property damage on the job site.

What Scenarios Call for General Liability Insurance?

These are the risks every contractor faces on almost every project:

Example: A homeowner trips over your equipment on-site and sues for medical expenses. General liability coverage steps in to handle the resulting claim.

What Does General Liability Insurance Cover?

Typical coverage for general liability includes:

Third-party bodily injury claims

Third-party property damage claims caused by your operations

Legal fees and settlement costs

Product liability for materials used during a project

This type of insurance ensures that your business is protected from lawsuits stemming from accidents or mishaps on-site.

What General Liability Does Not Cover

General liability does NOT cover claims arising from design or advice-related errors. For instance, if a structural flaw emerges due to a design mistake you made, general liability would not cover that claim—that’s when professional liability becomes critical.

Comparing Professional and General Liability Insurance

Both coverages address distinctly different but equally important risks. Choosing the correct policy depends on your role and responsibilities within your business and the scope of your projects.

Why Contractors Might Need Both Policies

Many contractors find it beneficial to hold both professional liability and general liability insurance policies. Having both ensures full-spectrum protection for various scenarios, from design errors to on-site accidents.

Consider this example:

Scenario: You’re contracted to design and build an office space. If design flaws result in structural issues, professional liability insurance covers that. If a visitor trips over your equipment during construction, general liability insurance covers that claim.

For comprehensive coverage, many contractors combine these policies into one risk management strategy.

The Benefits of Partnering with an Expert

Finding the right insurance isn’t always easy. Each business is unique, and cookie-cutter solutions often leave contractors exposed to significant risks. That’s why working with an insurance expert who understands the challenges contractors face can make all the difference.

With over 20 years of experience helping contractors, I specialize in providing tailored liability insurance solutions that balance affordability and comprehensive protection. My proven track record has helped contractors save 10-30% on costs without compromising coverage.

How I Can Help You

Assess your unique risks and provide expert recommendations.

Navigate complex policies to ensure seamless protection.

Secure cost-effective coverage based on your business size and needs.

When partnering with me, you don’t just get insurance coverage; you gain a dedicated advisor invested in your protection and success.

Secure Your Peace of Mind Today

Choosing the right liability coverage is a vital step in protecting your business and reputation. Don’t wait to safeguard your livelihoods against costly claims that threaten your growth.

Book a call with me today, and together, we’ll build a tailored insurance plan that sets your business up for long-term success. I’m here to help. Book a call or email me at Bret@BGAgencyins.com.

Make protecting your investments easy, efficient, and financially sound.